|

|

|

|

|

|

|

|

|

|||

|

|

|

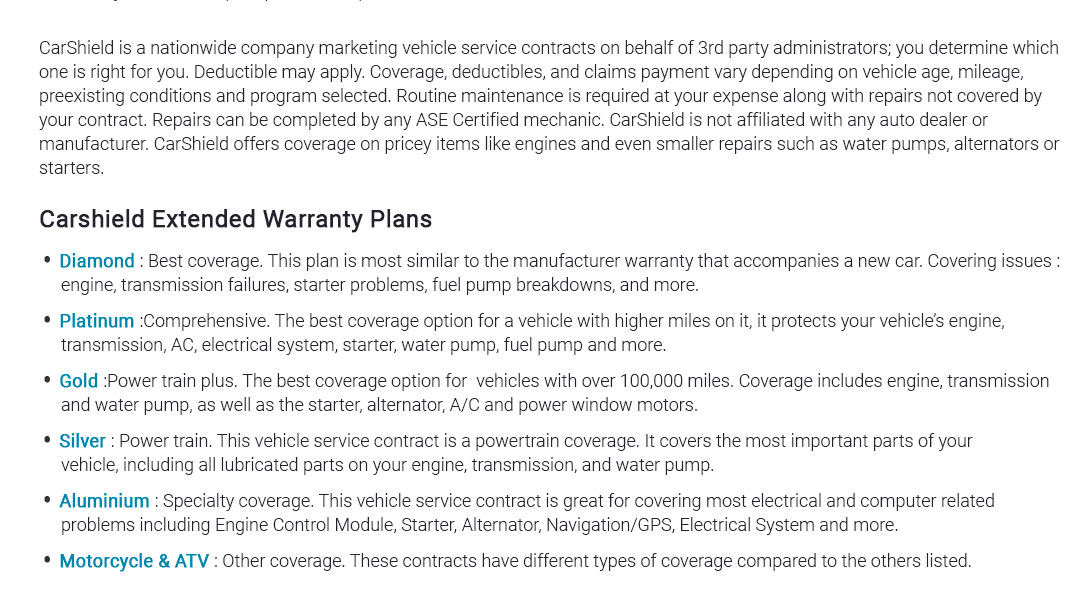

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

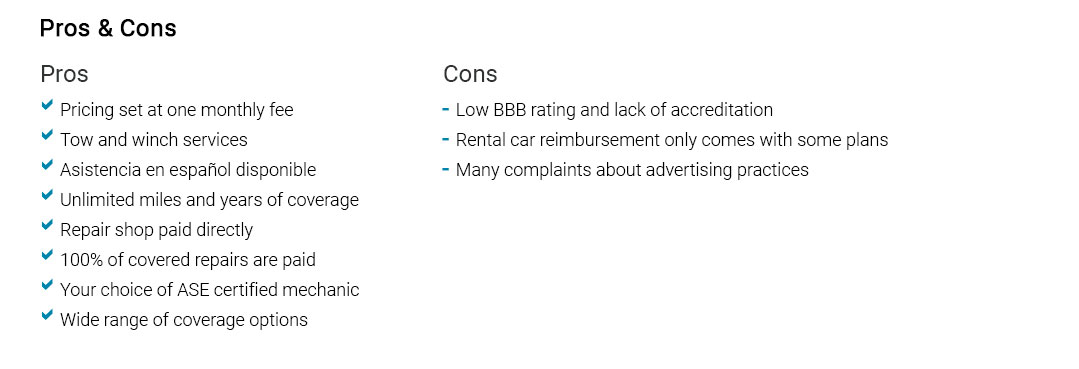

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

insurance gap coverage decoded for real-life decisionsExploring policies is easier with a compass. Insurance gap coverage is that compass pointing to the space between what a standard policy pays and what you still owe or must spend. It guards against surprise shortfalls. What it actually bridgesAuto loans and leases: if a car is totaled, insurers pay actual cash value; a gap policy can cover the difference to the payoff. Health supplements: can offset deductibles or coinsurance for specific events. The aim is relevance, not excess. Costs are modest relative to worst-case losses.

One moment that made it clickA coworker totaled a nine-month-old hatchback on black ice. The insurer's check left a $4,300 balance. Gap coverage erased it, and she returned the rental without a knot in her stomach.

Pragmatic caveat: gap coverage doesn't cover late payments, add-on warranties, or rolled-in old debt beyond stated caps, and claims need timely reporting. Awareness first; choose only what fills a real gap. If the numbers don't show a gap, skip it. https://www.progressive.com/answers/gap-insurance/

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. https://www.geico.com/auto-insurance/gap-insurance-coverage/

Gap insurance is a type of auto insurance typically purchased for leased or financed vehicles. If your vehicle is totaled, your standard auto insurance policy ... https://www.allstate.com/resources/car-insurance/gap-insurance-coverage

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's ...

|